What are cryptocurrency savings accounts?

A crypto savings account is a location to store your cryptocurrency assets. You can withdraw your assets, just as in a traditional savings account. However, the conditions differ depending on the cryptocurrency exchange and account type. Deposits typically earn interest instead of simply storing your cryptocurrency in a crypto wallet.

In case you want to know how profit is made, it is quite similar to a bank’s savings account where the bank lends out your money with interest, and you get a part of it. The only difference is the currency being exchanged. While a typical savings account uses fiat money like the dollar or pounds, a cryptocurrency savings account uses cryptocurrencies like Bitcoin or USD Coin.

How to select a cryptocurrency savings account

Selecting a cryptocurrency savings account is not necessarily as simple as picking a shirt to wear; there has to be a level of due diligence on your path, and we have chosen to help you filter the available options using some key parameters. When picking a cryptocurrency savings account, there are four key parameters to look at.

Disclaimer: Cryptocurrency savings accounts are not related in any way to bank savings accounts. Bank savings accounts are covered by a Government Deposit Guarantee. Cryptocurrency savings accounts are not covered by the Australian Government Guarantee on Deposits.

What asset is it backed by?

This is very key when searching for a cryptocurrency savings account. What is that savings platform backed by? Under normal circumstances and in a normal bank, your savings are backed up to an extent by funds set apart for such purposes. Accounts could either be backed by fiat currency or by cryptocurrency.

How stable is this asset?

Next, you have to look at the stability of the asset. Does the asset fluctuate too much on the market? Is it an asset that people are willing to hold over a given period? The stability could also depend on the account backer.

If a cryptocurrency savings account is backed by fiat currency, it is likely to be more stable than one backed by just cryptocurrencies. For example, Chillur Earn uses USD Coin, a cryptocurrency that is backed 1:1 by the US Dollar.

Is the interest rate higher than inflation?

One reason people look for investment options is to beat inflation and to do this, you have to know the inflation rate and look for a cryptocurrency savings account that offers a return rate that beats inflation.

Is the interest rate higher than what is available through bank savings accounts?

Another key thing to look out for is the rate offered by the cryptocurrency savings accounts and compare them with banks. If the rates are not better, then there is hardly any point investing in them.

What are the benefits of using cryptocurrency savings accounts?

The benefits of cryptocurrency savings account is what’s making them popular despite having been around only for a few years.

Opportunities for diversification

Every investor understands the importance of having a diversified portfolio, i.e. a portfolio that has more than one type of asset. For those who already invest in the stock market, real estate, or the forex market, having a cryptocurrency savings account offers another form of almost certain investment that further diversifies their portfolio.

Higher interest rates

The interest rates on cryptocurrency savings accounts have made it very popular. Their rates are often higher than inflation and standard bank rates, which will always attracts investors.

Low bar of entry

One reason cryptocurrencies have always been fascinating is their low entry barrier. Some cryptocurrency savings accounts would allow you to begin your savings with as little as $1, This is not usually the case with standard bank savings accounts

Higher flexibility

Banks do not offer the withdrawal and deposit flexibility that cryptocurrencies offer. Depending on your preference, you can choose how constantly you can save, and if you need to liquidate your crypto urgently, you can do that too.

What are the risks of using cryptocurrency savings accounts?

Cryptocurrencies are volatile investments that come with substantial risk of loss of value, performance is unpredictable and past performance is no guarantee of future performance. Cryptocurrency savings accounts also face similar risks and therefore it’s very important to be clear on the risks involved when using cryptocurrency savings accounts

No government guarantees or protections

A major drawback of cryptocurrency savings accounts is that they are not backed by government guarantees and there is no safety net when using cryptocurrency savings accounts. Your funds and investments therefore are not protected and you stand the risk of losing all your funds.

Volatility of cryptocurrency

Another major risk to using cryptocurrency savings accounts is that cryptocurrencies are volatile. While this is subjective because some coins are much more stable than others, general volatility is still attached to the cryptocurrency market.

How to earn interest with cryptocurrency savings accounts in Australia

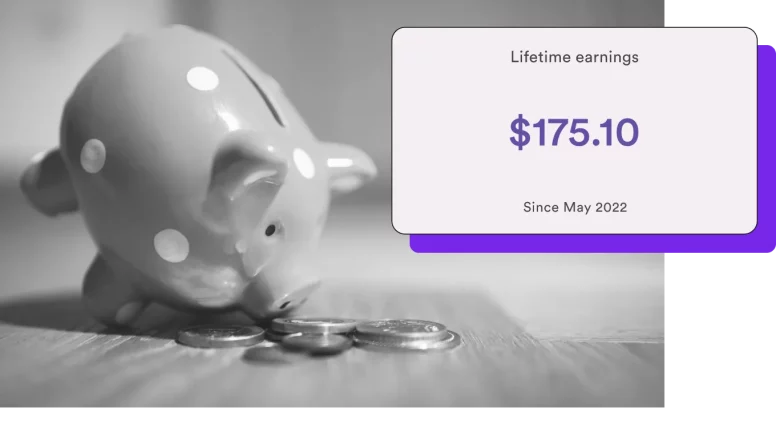

Chillur offers a product called Chillur Earn where you can start seeing the benefits from your micro-investment the very next day.

With Chillur Earn, you use your money to buy a cryptocurrency called USD Coin (aka USDC). Once you buy USDC, you can earn interest in your holdings every day with the interest compounding daily.

You can micro-invest in cryptocurrency in Australia using the buy and hold strategy using Chillur in three easy steps.

Step 1: Create an account

Create your Chillur account using an email address and password. You will then need to verify your identity using either your passport or drivers licence.

Step 2: Buy USDC as part of Chillur Earn

Chillur Earn enables you to earn daily interest on your USDC holdings.

The bigger your USDC balance, the more you earn every day in compound interest.

Step 3: Track your investment performance

Simply login into your Chillur account and track the performance of your portfolio either through a laptop or your mobile phone.

One thing you would have realised is that cryptocurrency investing is super easy. And that is the truth. Most people get tripped up because they just don’t start, not because it’s difficult.

In fact, the most common reason that most people give for not investing is that they don’t know where to start. The second most common reason is that they just haven’t gotten around to doing it.

Hopefully, this article has helped you overcome the first question. And now that you know the answer to how to micro-invest in cryptocurrency in Australia, you are ready to take the first step.